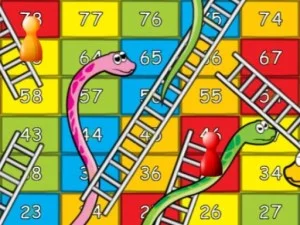

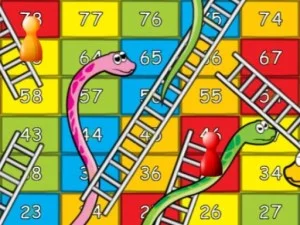

Lof Snakes and Ladders

Classic Snakes and Ladders game with interesting design. Enjoy playing with your computer or mobile device.

Classic Snakes and Ladders game with interesting design. Enjoy playing with your computer or mobile device.

Categories and tags of the game : 2 Player, Board, Boardgames, Dice, Html5, Html5games

Classic Snakes and Ladders game with interesting design. Enjoy playing with your computer or mobile device.

Classic Snakes and Ladders game with interesting design. Enjoy playing with your computer or mobile device.