Introduction:

Real estate investing for beginners can be a daunting task, but with the right guidance, it can be a lucrative venture. Investing in real estate provides a tangible asset, potential for long-term appreciation, and a steady income stream. As a beginner, it’s essential to understand the basics of real estate investing, including the different types of investments, financing options, and strategies for success. In this article, we’ll provide a comprehensive guide to real estate investing for beginners, covering the essential concepts, tips, and best practices to get started.

Getting Started with Real Estate Investing

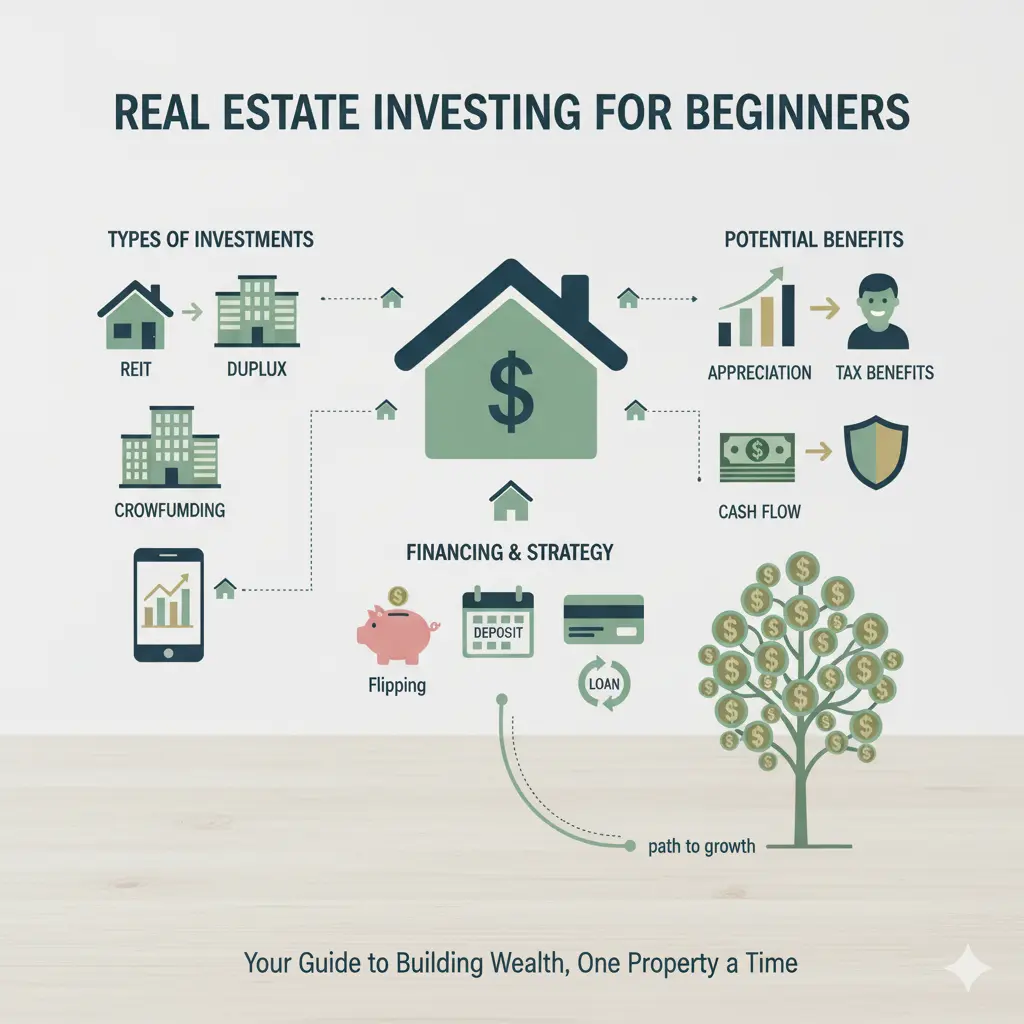

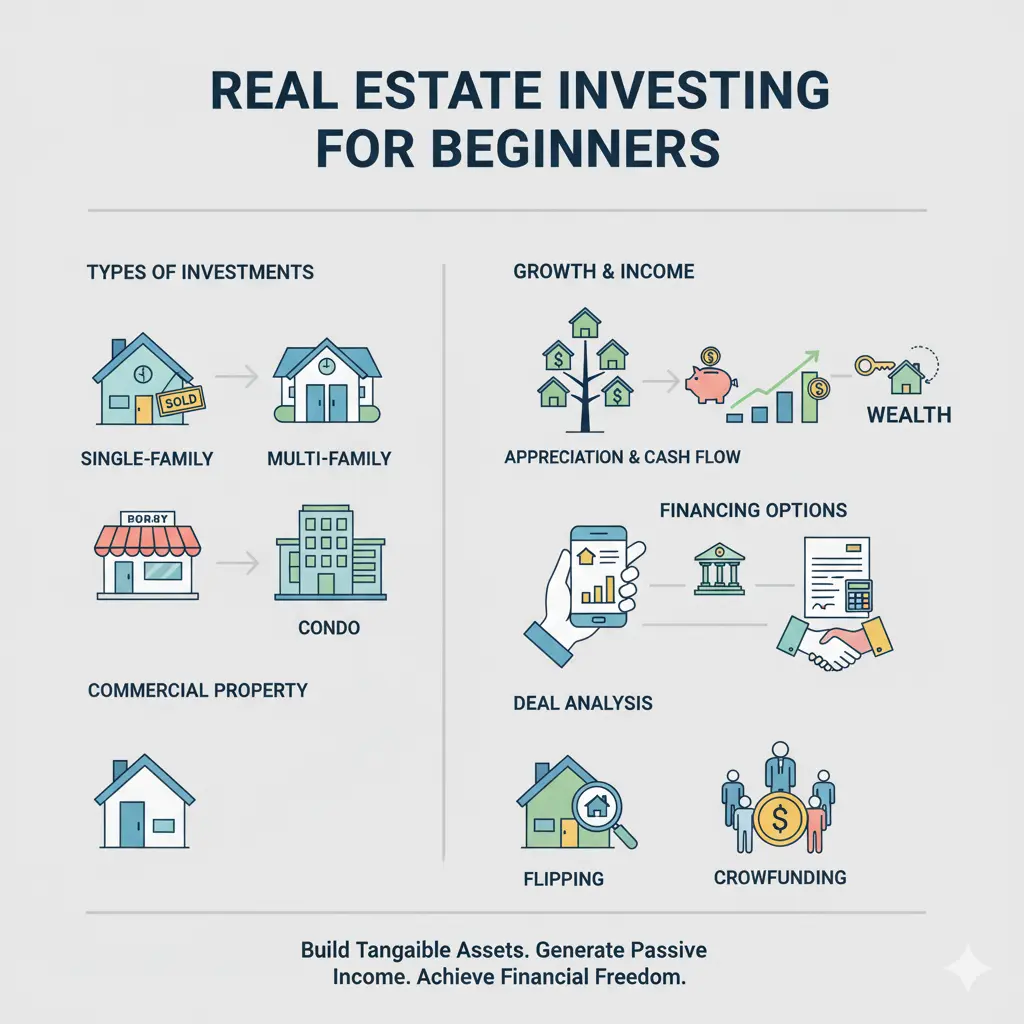

Real estate investing for beginners starts with understanding the different types of investments available. The most common types of real estate investments include rental properties, real estate investment trusts (REITs), real estate crowdfunding, and wholesaling. Rental properties involve purchasing a property and renting it out to tenants, providing a steady income stream. REITs allow individuals to invest in real estate without directly managing properties, while real estate crowdfunding platforms enable investors to pool their funds to invest in larger projects. Wholesaling involves purchasing a property with the intention of selling it quickly for a profit. Each type of investment has its pros and cons, and it’s crucial to research and understand the risks and rewards before making a decision.

To get started with real estate investing, beginners should also consider their financial situation, credit score, and investment goals. A good credit score can help secure better financing options, while a solid understanding of investment goals can help guide the decision-making process. Additionally, beginners should research the local real estate market, including current trends, prices, and rental yields. This information can help identify potential opportunities and avoid costly mistakes. With the right mindset and preparation, real estate investing for beginners can be a rewarding and profitable experience.

Understanding Real Estate Investment Strategies

Real estate investment strategies are crucial for success, and beginners should understand the different approaches to investing. One popular strategy is the buy-and-hold approach, which involves purchasing a property and holding it for an extended period. This approach can provide long-term appreciation and a steady income stream. Another strategy is the fix-and-flip approach, which involves purchasing a property, renovating it, and selling it quickly for a profit. This approach requires a deeper understanding of the local market and construction costs, but can provide a higher potential return on investment.

Beginners should also consider the concept of leverage, which involves using borrowed money to finance a real estate investment. Leverage can amplify potential returns, but also increases the risk of default. A solid understanding of financing options, including mortgages, hard money loans, and private money lending, is essential for making informed decisions. Additionally, real estate investing for beginners should involve a thorough analysis of the local market, including current trends, prices, and rental yields. This information can help identify potential opportunities and avoid costly mistakes. By understanding the different investment strategies and approaches, beginners can make informed decisions and increase their chances of success.

Real Estate Financing Options for Beginners

Real estate financing options are a critical aspect of investing, and beginners should understand the different types of financing available. Traditional mortgages are a popular option, offering competitive interest rates and flexible repayment terms. However, traditional mortgages often require a significant down payment and strict credit requirements. Hard money loans, on the other hand, offer a faster and more flexible financing option, but often come with higher interest rates and fees. Private money lending is another option, which involves borrowing money from individual investors or private companies.

Beginners should also consider the concept of owner financing, which involves the seller providing financing to the buyer. This approach can be beneficial for both parties, as it provides a flexible financing option and can help facilitate the sale. Additionally, real estate investing for beginners should involve a thorough understanding of the financing process, including credit scores, debt-to-income ratios, and loan-to-value ratios. A solid understanding of these concepts can help navigate the financing process and secure the best possible terms. By exploring the different financing options and understanding the financing process, beginners can increase their chances of success and achieve their investment goals.

Real estate investing for beginners also involves understanding the tax implications of investing. The tax benefits of real estate investing can be significant, including deductions for mortgage interest, property taxes, and operating expenses. However, beginners should also be aware of the potential tax liabilities, including capital gains tax and depreciation recapture. A solid understanding of the tax implications can help minimize tax liabilities and maximize tax benefits. By consulting with a tax professional and understanding the tax implications, beginners can make informed decisions and optimize their investment strategy.

Real Estate Investment Analysis and Due Diligence

Real estate investment analysis and due diligence are critical components of successful investing. Beginners should understand the importance of analyzing potential investments, including the property’s condition, location, and market trends. A thorough analysis can help identify potential opportunities and avoid costly mistakes. The 1% rule, which involves ensuring the property’s monthly rent is at least 1% of the purchase price, is a useful guideline for evaluating potential investments. Additionally, beginners should consider the 50/30/20 rule, which involves allocating 50% of the property’s income towards operating expenses, 30% towards debt service, and 20% towards cash flow.

Beginners should also conduct thorough due diligence on potential investments, including reviewing property records, inspecting the property, and researching the local market. A thorough due diligence process can help identify potential issues and avoid costly mistakes. Real estate investing for beginners should also involve a solid understanding of the concept of cash flow, which involves the property’s income minus expenses. A positive cash flow can provide a steady income stream and increase the potential for long-term appreciation. By conducting thorough analysis and due diligence, beginners can make informed decisions and increase their chances of success.

Real estate investing for beginners also involves understanding the importance of property management. A well-managed property can provide a steady income stream and increase the potential for long-term appreciation. Beginners should consider hiring a property management company or managing the property themselves. A solid understanding of property management concepts, including tenant screening, lease agreements, and maintenance schedules, is essential for success. By prioritizing property management and conducting thorough analysis and due diligence, beginners can optimize their investment strategy and achieve their goals.

Real Estate Investing Risks and Mitigation Strategies

Real estate investing risks are a critical aspect of investing, and beginners should understand the potential risks and mitigation strategies. One of the most significant risks is market volatility, which can affect property values and rental income. Beginners should also be aware of the risk of tenant vacancies, which can impact cash flow and increase the potential for costly evictions. Additionally, real estate investing for beginners involves understanding the risk of property damage, which can impact cash flow and increase the potential for costly repairs.

Beginners should also consider the concept of diversification, which involves spreading investments across different asset classes and geographic locations. Diversification can help mitigate risks and increase the potential for long-term appreciation. Real estate investing for beginners should also involve a solid understanding of risk management strategies, including insurance, warranties, and emergency funds. A thorough understanding of these concepts can help mitigate risks and increase the potential for success. By understanding the potential risks and mitigation strategies, beginners can make informed decisions and optimize their investment strategy.

Real estate investing for beginners also involves understanding the importance of ongoing education and professional development. The real estate market is constantly evolving, and beginners should stay up-to-date with the latest trends, strategies, and best practices. Attending seminars, workshops, and conferences can provide valuable insights and networking opportunities. Additionally, beginners should consider joining real estate investing clubs or online forums to connect with other investors and learn from their experiences. By prioritizing ongoing education and professional development, beginners can stay ahead of the curve and increase their chances of success.

Real estate investing for beginners should also involve a solid understanding of the concept of exit strategies, which involves planning for the eventual sale or disposition of the property. Beginners should consider the potential exit strategies, including selling the property, refinancing, or exchanging it for another property. A thorough understanding of exit strategies can help maximize returns and minimize tax liabilities. By understanding the potential risks and mitigation strategies, prioritizing ongoing education and professional development, and planning for exit strategies, beginners can make informed decisions and achieve their investment goals.

Conclusion and Final Thoughts

In conclusion, real estate investing for beginners requires a comprehensive understanding of the different types of investments, financing options, and strategies for success. By understanding the basics of real estate investing, including the different types of investments, financing options, and strategies for success, beginners can make informed decisions and increase their chances of success. Real estate investing for beginners involves a thorough analysis of the local market, including current trends, prices, and rental yields. A solid understanding of financing options, including mortgages, hard money loans, and private money lending, is essential for making informed decisions. By prioritizing property management, conducting thorough analysis and due diligence, and understanding the potential risks and mitigation strategies, beginners can optimize their investment strategy and achieve their goals.

Frequently Asked Questions

What is the best type of real estate investment for beginners?

The best type of real estate investment for beginners depends on their individual circumstances, including their financial situation, credit score, and investment goals. Rental properties, REITs, and real estate crowdfunding are popular options for beginners, as they provide a relatively low-risk and stable income stream.

How much money do I need to start investing in real estate?

The amount of money needed to start investing in real estate varies depending on the type of investment and financing options. Traditional mortgages often require a significant down payment, while hard money loans and private money lending may require less. Beginners should research and understand the different financing options and their requirements.

What are the risks of real estate investing?

The risks of real estate investing include market volatility, tenant vacancies, property damage, and financing risks. Beginners should understand the potential risks and mitigation strategies, including diversification, insurance, warranties, and emergency funds.

How do I get started with real estate investing?

To get started with real estate investing, beginners should research and understand the different types of investments, financing options, and strategies for success. They should also consider their financial situation, credit score, and investment goals. A thorough analysis of the local market, including current trends, prices, and rental yields, is essential for making informed decisions.

What are the benefits of real estate investing?

The benefits of real estate investing include potential long-term appreciation, a steady income stream, and tax benefits. Real estate investing can provide a tangible asset and a sense of control over the investment. By understanding the benefits and risks of real estate investing, beginners can make informed decisions and achieve their investment goals.