Introduction:

When it comes to personal finance, understanding the difference between wealth and income is crucial. Many people often confuse these two terms, but they represent distinct aspects of one’s financial situation. In this article, we will delve into the world of finance and explore the concept of wealth vs income explained, providing a comprehensive guide to help you navigate the complexities of building wealth and managing income.

Understanding Wealth and Its Significance

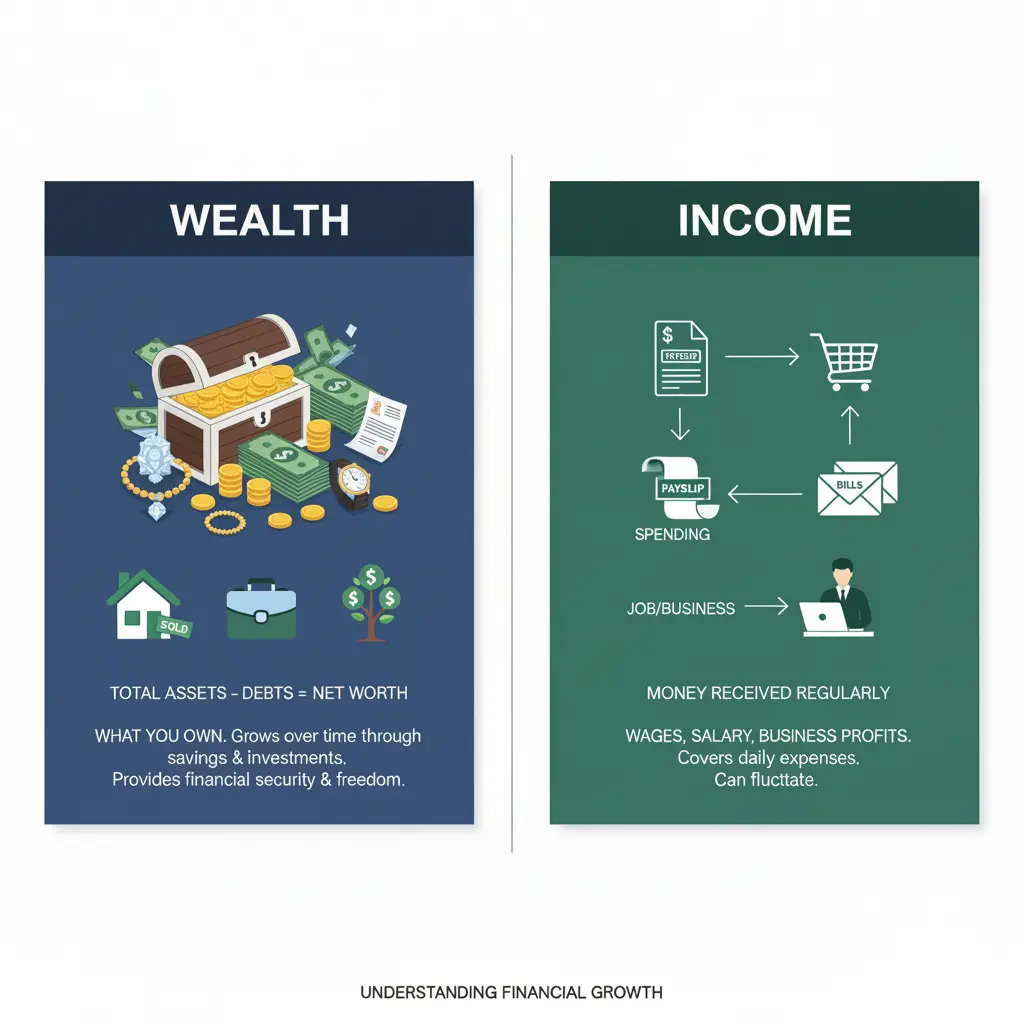

Wealth refers to the total value of assets owned by an individual, including cash, investments, real estate, and other valuables. It represents the accumulated riches over time, providing a financial cushion and security for the future. Building wealth requires a long-term perspective, discipline, and a well-thought-out strategy. Wealth is not just about having a lot of money; it’s about creating a sustainable financial foundation that can weather economic downturns and provide opportunities for growth. A person with significant wealth can enjoy financial independence, pursue their passions, and create a lasting legacy.

Wealth is often measured by net worth, which is the total value of assets minus liabilities. For instance, if you own a house worth $500,000, have $200,000 in investments, and $100,000 in savings, but also have a $300,000 mortgage and $50,000 in credit card debt, your net worth would be $350,000. Understanding your net worth is essential to creating a wealth-building plan, as it helps you identify areas for improvement and make informed decisions about investments and debt management.

The Concept of Income and Its Role in Wealth Creation

Income, on the other hand, refers to the money earned from various sources, such as a salary, wages, tips, dividends, or rent. It represents the flow of money into your financial system, providing the means to cover living expenses, pay debts, and build wealth. Income is essential for creating wealth, as it provides the fuel for investing, saving, and accumulating assets. However, income alone is not sufficient for building wealth; it’s the management of income that determines one’s ability to create wealth. A person with a high income but poor money management skills may struggle to build wealth, while someone with a modest income but a solid financial plan can achieve significant wealth over time.

Income can be categorized into different types, including active income, passive income, and portfolio income. Active income is earned through direct involvement, such as a job or freelance work. Passive income is generated through investments, such as rental properties or dividend-paying stocks. Portfolio income is earned through the sale of assets, such as stocks, bonds, or real estate. Understanding the different types of income and creating a diverse income stream can help you build wealth more efficiently and reduce financial risk.

Building Wealth through Smart Investing and Money Management

Building wealth requires a combination of smart investing, money management, and patience. Investing in assets that have a high potential for growth, such as stocks or real estate, can help you build wealth over time. However, investing always involves risk, and it’s essential to educate yourself and develop a well-thought-out investment strategy. Diversification is key to reducing risk and increasing potential returns, so it’s crucial to spread your investments across different asset classes and industries. Additionally, avoiding debt and creating a budget can help you manage your income more effectively and allocate more resources towards building wealth.

Wealth creation also involves tax planning and optimization. Taxes can significantly impact your wealth-building efforts, so it’s essential to understand tax laws and regulations and develop strategies to minimize tax liabilities. For instance, investing in tax-advantaged accounts, such as 401(k) or IRA, can help you reduce taxes and build wealth more efficiently. Moreover, charitable giving and estate planning can also play a crucial role in wealth creation, as they can help you reduce taxes, create a lasting legacy, and ensure that your wealth is transferred to future generations in a tax-efficient manner.

Creating multiple income streams is another essential aspect of building wealth. Diversifying your income can help you reduce financial risk and increase your wealth-building potential. This can be achieved by starting a side business, investing in dividend-paying stocks, or generating passive income through real estate or intellectual property. Having multiple income streams can provide a financial safety net and give you the freedom to pursue your passions and interests without worrying about money.

The Importance of Financial Literacy and Education

Financial literacy and education are critical components of building wealth and managing income. Understanding personal finance concepts, such as budgeting, saving, and investing, can help you make informed decisions about your financial resources. Financial literacy also involves understanding the different types of investments, such as stocks, bonds, and real estate, and how to manage risk and optimize returns. Moreover, staying up-to-date with market trends, economic developments, and tax laws can help you adapt to changing financial circumstances and make adjustments to your wealth-building strategy.

Financial education can be acquired through various sources, including books, online courses, and financial advisors. It’s essential to be proactive and take control of your financial education, as it can have a significant impact on your wealth-building efforts. Additionally, avoiding get-rich-quick schemes and staying away from unscrupulous financial advisors can help you protect your financial resources and build wealth over time. By prioritizing financial literacy and education, you can develop a solid foundation for building wealth and achieving financial independence.

Developing a long-term perspective is also essential for building wealth. Wealth creation is a marathon, not a sprint, and it requires patience, discipline, and persistence. It’s crucial to avoid getting caught up in short-term market fluctuations and focus on long-term trends and opportunities. By doing so, you can create a wealth-building strategy that is tailored to your financial goals and risk tolerance, and make adjustments as needed to stay on track. Moreover, celebrating small victories and staying motivated can help you overcome obstacles and stay committed to your wealth-building journey.

Overcoming Obstacles and Staying Motivated on the Path to Wealth

Building wealth is not without its challenges, and overcoming obstacles is an essential part of the journey. Setbacks, such as job loss, market downturns, or unexpected expenses, can derail your wealth-building efforts and test your resolve. However, it’s essential to stay motivated and focused on your financial goals, even in the face of adversity. By developing a growth mindset, learning from failures, and adapting to changing circumstances, you can overcome obstacles and stay on track.

Staying motivated also involves celebrating small victories and acknowledging progress along the way. By breaking down your wealth-building goals into smaller, manageable tasks, you can create a sense of accomplishment and momentum. Additionally, surrounding yourself with like-minded individuals, such as financial mentors or peers, can provide support, guidance, and motivation. By staying positive, focused, and committed to your wealth-building journey, you can overcome obstacles and achieve financial independence.

Creating a wealth-building community can also play a crucial role in staying motivated and overcoming obstacles. Connecting with others who share similar financial goals and values can provide a sense of belonging, support, and accountability. By sharing knowledge, experiences, and resources, you can learn from others, gain new insights, and stay motivated. Moreover, participating in online forums, attending financial seminars, or joining investment clubs can help you expand your network, access new opportunities, and stay up-to-date with market trends and developments.

Conclusion and Final Thoughts

In conclusion, understanding the difference between wealth and income is essential for building wealth and achieving financial independence. Wealth represents the total value of assets owned, while income refers to the money earned from various sources. Building wealth requires a combination of smart investing, money management, and patience, as well as a deep understanding of personal finance concepts and market trends. By prioritizing financial literacy and education, developing a long-term perspective, and overcoming obstacles, you can create a wealth-building strategy that is tailored to your financial goals and risk tolerance.

By applying the principles outlined in this article, you can take control of your financial resources, build wealth over time, and achieve financial independence. Remember, wealth creation is a marathon, not a sprint, and it requires discipline, persistence, and patience. Stay motivated, focused, and committed to your wealth-building journey, and you will be well on your way to achieving financial freedom and security.

FAQs

What is the difference between wealth and income?

Wealth refers to the total value of assets owned, while income refers to the money earned from various sources.

How do I build wealth?

Building wealth requires a combination of smart investing, money management, and patience, as well as a deep understanding of personal finance concepts and market trends.

What is the importance of financial literacy and education?

Financial literacy and education are critical components of building wealth and managing income, as they help you make informed decisions about your financial resources and adapt to changing financial circumstances.

How do I overcome obstacles on the path to wealth?

Overcoming obstacles requires developing a growth mindset, learning from failures, and adapting to changing circumstances, as well as staying motivated and focused on your financial goals.

What is the role of income in building wealth?

Income provides the fuel for investing, saving, and accumulating assets, and is essential for creating wealth, but it’s the management of income that determines one’s ability to build wealth.